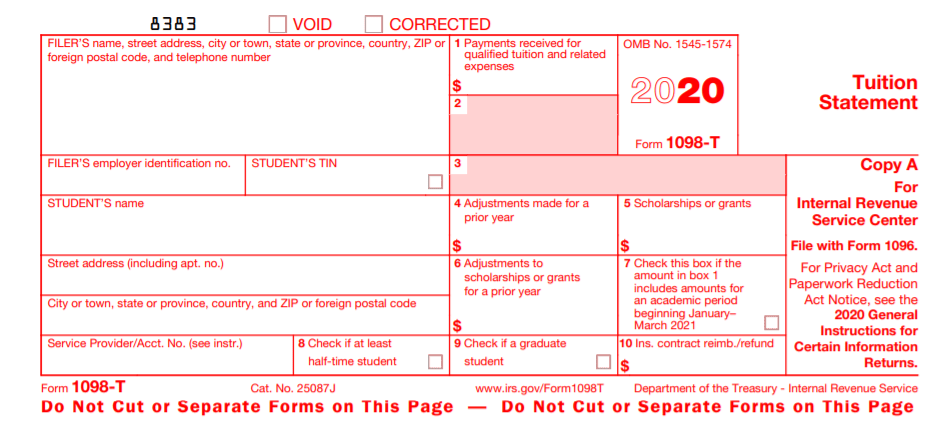

Username: Temple Student ID beginning with 9.In order to receive a 1098-T form, students must have an active permanent address to be reported to the IRS.Ĭurrently enrolled students can access 1098-T information and transaction details in TUpay by selecting TCS1098-T:įormer students can access forms at: Enter the following information: Students can choose electronic delivery or by mail to the student’s permanent address of record. Temple University is required to provide all students with a 1098-T tax form that records certain required information.įederal 1098-T forms are distributed by January 31 each year to students who meet the Internal Revenue Services’ reporting requirements. You may claim the Lifetime Learning Credit if all three of the following requirements are met.

Generally, the credit is allowed for qualified education expenses paid in the current tax year for an academic period beginning in the current tax year or in the first 3 months of the following tax year. The Lifetime Learning Credit is based on qualified education expenses you pay for yourself, your spouse, or a dependent for which you claim an exemption on your tax return.

Unlike a deduction, which reduces the amount of income subject to tax, a credit directly reduces the tax itself. A tax credit reduces the amount of income tax you may have to pay.The American opportunity credit is up to $2,500 for qualified education expenses paid for each eligible student. The taxpayer will need to decide which credit they are eligible to receive.

There are two tax credits available to help you offset the costs of higher education by reducing the amount of your income tax these are the American opportunity credit and the lifetime learning credit.

0 kommentar(er)

0 kommentar(er)